Washington State’s Department of Labor & Industries (L&I) has issued its official overtime pay proposal. In short, L&I is proposing to raise the overtime pay threshold (the minimum below which employees must be paid overtime for over 40 hours of work in a week) to 2.5x the minimum wage by 2026. This equates to a threshold annual salary of over $70,000. We know many nonprofits will be affected by this proposed rule, so we are committed to keeping you informed. Watch our webinar below and read on to learn how you can provide input during the next round of hearings.

Click here to download the slide deck from the presentation.

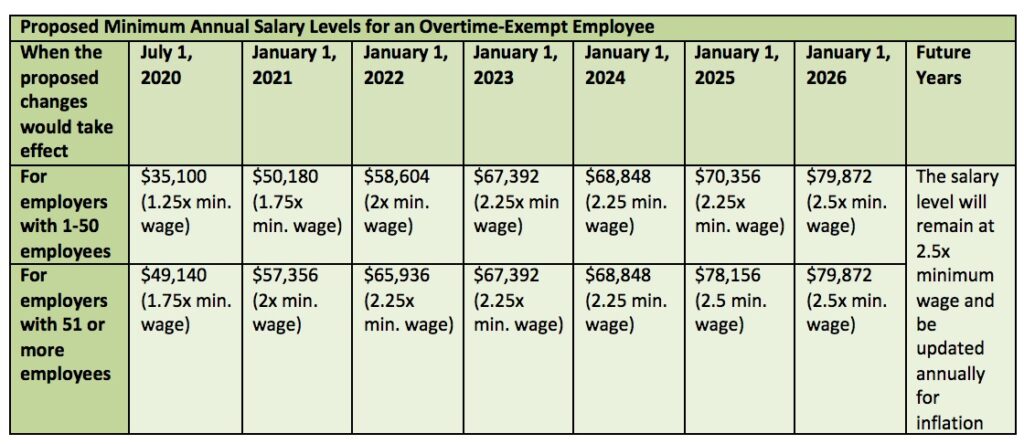

The new threshold will be phased in beginning in July 1, 2020 and incrementally increase to the 2.5x level by 2026. The proposed threshold increases are pictured in the tables below.

When reviewing the proposal and fact sheet, please note:

- There are different phase-in schedules proposed for employers of less than 50 people and more than 50 people.

- L&I is using a weekly measurement of pay to calculate the threshold, rather than an annual salary. To arrive at the annual salary for employees, multiply the weekly threshold amount by 52, like this: Threshold x 52 Weeks = Annual Salary

- The proposed increases are tied to a multiplier of the minimum wage. This means that once the phase-in is complete, the threshold will automatically rise each year based on the Consumer Price Index.

- Employees earning under the weekly salary threshold will be entitled to overtime pay if they work above 40 hours in a week, regardless of whether they meet the duties test for executive, administrative, and professional workers.

Click here to download and view the salary tables

Next Steps

1. L&I will be holding public hearings on its proposal in July and August. Hearings are currently scheduled in Tumwater, Seattle, Bellingham, Ellensburg, Kennewick, Spokane, Vancouver, and online.

| City: | Tumwater | Seattle | Bellingham | Online |

| Date : | July 15, 2019 | July 16, 2019 | July 17, 2019 | July 23, 2019 |

| Time: | 1 PM to 4 PM | 9 AM to 12 PM | 9 AM to 12 PM | 10:00 AM to 11:30 AM |

| Venue: | L&I Headquarters 7273 Linderson Way SW Tumwater 98501 | The Swedish Club 1920 Dexter Ave N Seattle 98109 | Four Points By Sheraton 714 Lakeway Dr Bellingham 98229 | Click here for log in information |

| City: | Ellensburg | Kennewick | Spokane | Vancouver |

| Date: | August 5, 2019 | August 6, 2019 | August 7, 2019 | August 15, 2019 |

| Time: | 9 AM to 12 PM | 9 AM to 12 PM | 9 AM to 12 PM | 9 AM to 12 PM |

| Venue: | Hal Holmes Community Center 201 Ruby St Ellensburg 98926 | Springhill Suites 7048 W Grandridge Blvd Kennewick 99336 | CenterPlace Regional Event Center 2426 N Discovery Pl Spokane Valley 99216 | Clark College Columbia Tech Center 18700 SE Mill Plain Blvd Vancouver 98683 |

Click here to view the latest hearing details. If a hearing is in your area, please plan to attend. We will be hosting check in calls prior to the hearings that will cover how to prepare and what to expect at the hearings. Please register for one of the calls if you plan to attend:

- July 12, 2019 at 10 AM: Check in Call for the Western Washington Hearings

- August 2, 2019 at 10 AM: Check in Call for the Central and Eastern Washington Hearings

2. L&I will be accepting written comments on the proposal. Please consider submitting written comments after you have analyzed what the changes mean for your organization. Comments must be submitted by September 6, 2019 by emailing [email protected] or faxing comments to 360-902-5300. Additional submission instructions are available in this fact sheet and on L&I’s overtime page.

What You Can Do

- Please review this fact sheet and the full proposal.

- Start thinking about what the increased salary threshold means for your employees and business model.

- Please make sure that your membership with Washington Nonprofits is current so that you receive the latest information about the rule making. Please contact our Membership Manager to check your membership or join.

- Make sure you and other appropriate people from your organization are signed up for our Public Policy and Advocacy Updates email list.

- Watch for updates from us about this.